IncParadise Resolution to Open Bank Accounts 2005-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

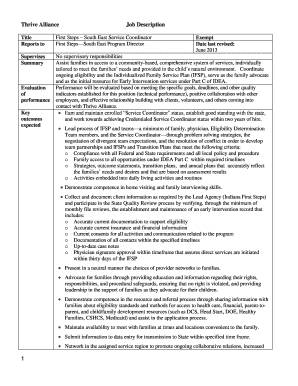

Edit and sign in one place

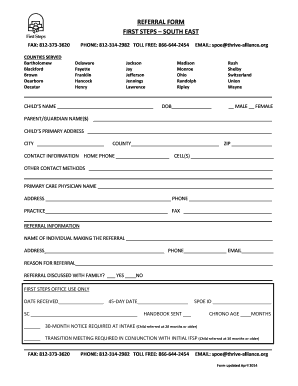

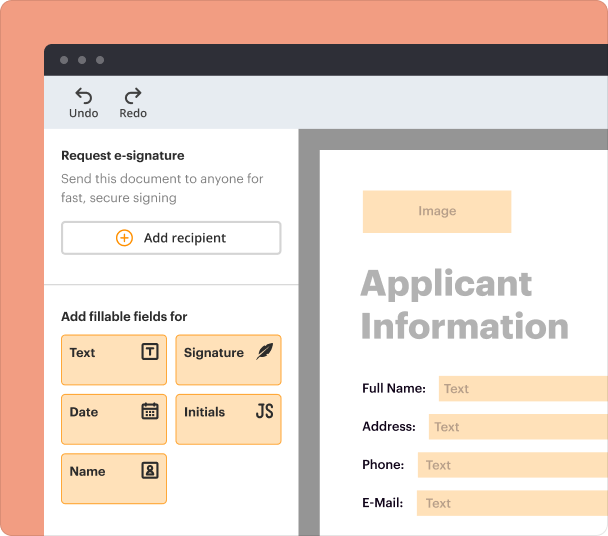

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Resolution to Open Bank Accounts Guide

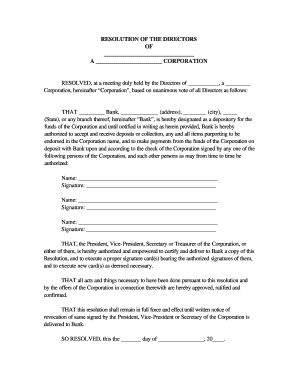

What is a resolution to open bank accounts?

A banking resolution is a formal document adopted by a corporation or LLC to authorize the opening and management of bank accounts. This document is essential for establishing official banking relationships and ensuring compliance with state laws governing corporate governance and operations.

-

It's a documented decision made by a corporation's board that outlines the intent to manage bank accounts.

-

This resolution legitimizes the banking activities and protects the company by formally designating who can act on its behalf.

-

Various states may have specific requirements, and adherence to these laws keeps the corporation in good standing.

What are the key components of the resolution template?

When creating a banking resolution, certain elements must be included to ensure completeness and legality. These components are vital for clarity and to protect the interests of the corporation.

-

It's crucial to spell out the official name of the corporation as registered, as this identifies the entity involved in the banking process.

-

Consider bank reputation, fees, and services offered, as these factors directly affect the overall banking relationship.

-

List individuals who will have account managing authority, specifying their roles such as treasurer or president.

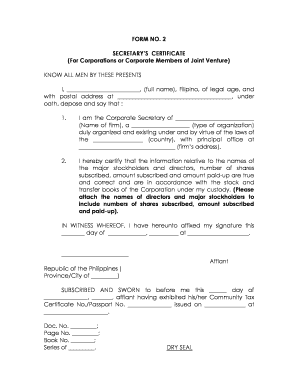

How do fill out the resolution form?

Completing the resolution form correctly enhances your corporation’s banking process. By following a step-by-step approach, you can avoid common pitfalls that may arise during the documentation.

-

Begin by gathering all necessary information, including corporate details and signatory names before filling the form.

-

Watch out for misspellings and incorrect roles, which can lead to misunderstandings with the bank.

-

Double-check all entries and consider having another team member review the document before submission.

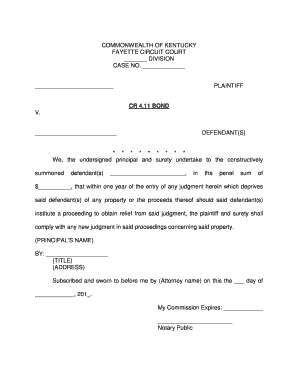

What are the legal implications of banking resolutions?

Understanding the legal context of a banking resolution is crucial as it impacts corporate governance and protects the entity and its signatory.

-

Ensures that powers are delegated appropriately, fostering accountability within the organization.

-

Different states may impose unique criteria for resolutions, making it important to be aware of local laws.

-

Signatories could be held accountable for transactions made under the resolution; thus, clear definitions of their roles should be established.

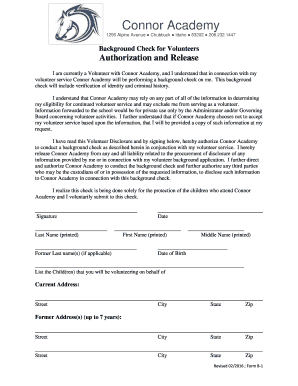

How can pdfFiller assist in document management?

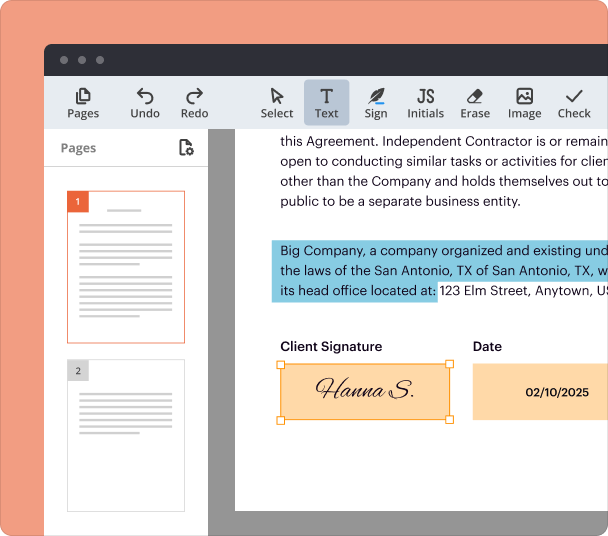

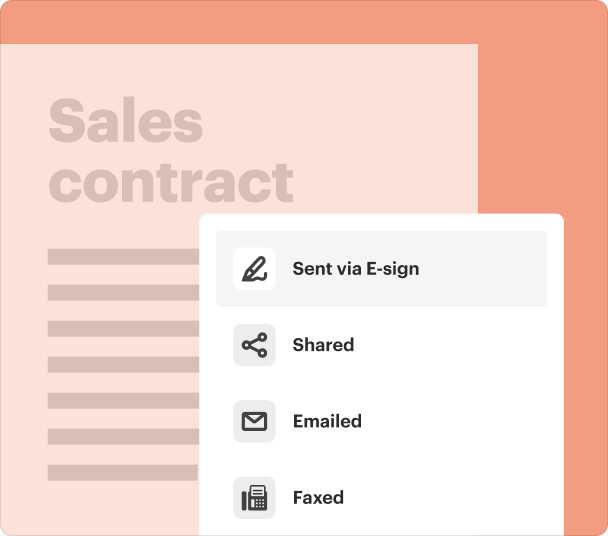

Using pdfFiller streamlines the process of creating and managing your banking resolution. Its features make it easy to edit, sign, and collaborate on necessary documents.

-

Users can quickly make changes to the resolution form and eSign it, removing the need for printing and physical signatures.

-

Teams can work together in real-time on the resolution, ensuring that all voices are heard and accounted for.

-

Monitor changes and updates to the resolution document as they occur, allowing for better project management.

What are the final steps after completing the resolution?

After your incparadise resolution to open form has been filled out, several essential steps should follow to ensure proper handling by your banking institution.

-

Deliver the completed resolution to your chosen banking institution to initiate account setup.

-

Store this document alongside other critical corporate documents such as bylaws and meeting minutes for future reference.

-

Conduct periodic reviews of your banking resolutions and related documents to ensure ongoing compliance with state and federal regulations.

Frequently Asked Questions about the resolution to open a restrictions placed on the account form

What happens if the resolution is not properly executed?

If a banking resolution is not executed correctly, the bank may refuse to open or manage the account. This can lead to complications in accessing funds or executing transactions on behalf of the corporation.

Can amendments be made to the resolution later?

Yes, amendments can typically be made to the resolution if circumstances change. It's essential to document any amendments formally and notify the bank of the changes promptly.

What documents are required alongside the resolution?

Supplementary documents often include the corporation's formation documents, bylaws, and identification for all authorized signatories. Having these ready facilitates a smoother banking process.

How can I ensure compliance with state laws?

Familiarizing yourself with state laws regarding bank account resolutions is key. Consulting legal professionals or utilizing resources like pdfFiller can help maintain compliance.

What are the consequences of not maintaining updated resolutions?

Failing to keep updated resolutions can lead to disputes regarding signatory authority and hinder financial operations. Regular reviews of your corporation’s banking resolutions are recommended to avoid such issues.

pdfFiller scores top ratings on review platforms